Starting a business is challenging as it is exciting and there are a lot of ups and downs an entrepreneur has to go through before the company begins generating revenue. But every entrepreneur plans on exiting or leaving a particular business venture. The reasons for leaving can be different: an early retirement, a failed startup, or moving on to a new, more exciting business. But to leave a company you need planning, and for that, you need a startup exit strategy. Having an exit strategy is almost as important as having a clear understanding of your startup idea.

Creating a thorough exit strategy will also help you decide when you should be moving on from a business. Every startup has its own challenges and its exit strategies should adhere to those but there are some common issues.

Table of Contents

What is a startup exit strategy?

An exit strategy, as is clear in the name is a template that helps an entrepreneur in leaving a company strategically, without suffering a loss or having to exit the business prematurely. An exit strategy also helps a business at transitioning to a bigger or better company. Exit strategies are not something you plan after you’ve started the business but it is to be incorporated into your initial business strategy so the process of exiting can be seamless.

Importance of having an exit strategy template

We have listed 5 reasons why your exit strategy is monumentally important–

Gives your company an aim: Without an exit strategy a business cannot be guided in a specific direction. Since the progress of a business is crystallized and can be measured by how early you can retire, it will also help you plan your life beyond business.

In addition, the strategy you have will also help you envision the next leader of the company. It can also help you decide whether to liquidate the assets and move on.

Makes you understand your company’s worth: Determining your business’s worth is more important than anything. Firstly, it will help you decline unsolicited offers to buy your business. In most buyouts, the offer is usually more profitable for the buyer. But you can avoid this if you know your company’s value and how much it will be in the future.

Secondly, it will help you understand which buyers are optimal and will pay the premium to buy your company.

You will know when to sell: That is the primary purpose of having an exit strategy. Additionally, the fixed exit timeframe( it can be a year, 5 years, or ten years) will pinpoint your focus to get your business to be buyer-ready.

You will be psychologically ready to exit: Leaving a business can be full of crises. One of which is the uncertainty of the future. With an exit strategy, you will be mentally prepared to leave the business way before you actually have to do it.

It will help you capitalize on the active market. There are certain times in the market when your business will be worth more than it ever has been. An exit strategy will help you predict the optimal time to exit the business.

Presentation of a startup exit strategy

While building a presentation for your buyer you have to consolidate your plans into points. Furthermore, you have to take the buyer’s motivations into consideration as well as yours. Following are some points you should keep in mind while presenting or planning a startup exit strategy.

Firstly, you have to consider your motivation and the buyer’s and make sure they align. Since your buyer also wants to know your motivation, in your presentation, you need to give a clear idea of what your motive behind exiting the business is.

Secondly, do your research on competitors who have been through mergers and acquisitions to gain an idea of where your company stands. For this, you will need to have a solid idea about your respective industries. Always be prepared with the statistics of comparable buy-out/acquisition/merger/liquidation deals.

Thirdly, when you’re thinking of exiting you should focus on revenue growth because the upwards graph will help to close the deal your way. To do this, you will need to pinpoint revenue benchmarks and funding requirements.

Fourthly, you have to start building relationships will potential acquirers and merger partners. This way, even though the market will evolve constantly, you will have options.

Lastly, your company has to stand out. When it comes to acquisitions, the market is very competitive because there is always more than one company looking for acquirers.

Startup exit statistics

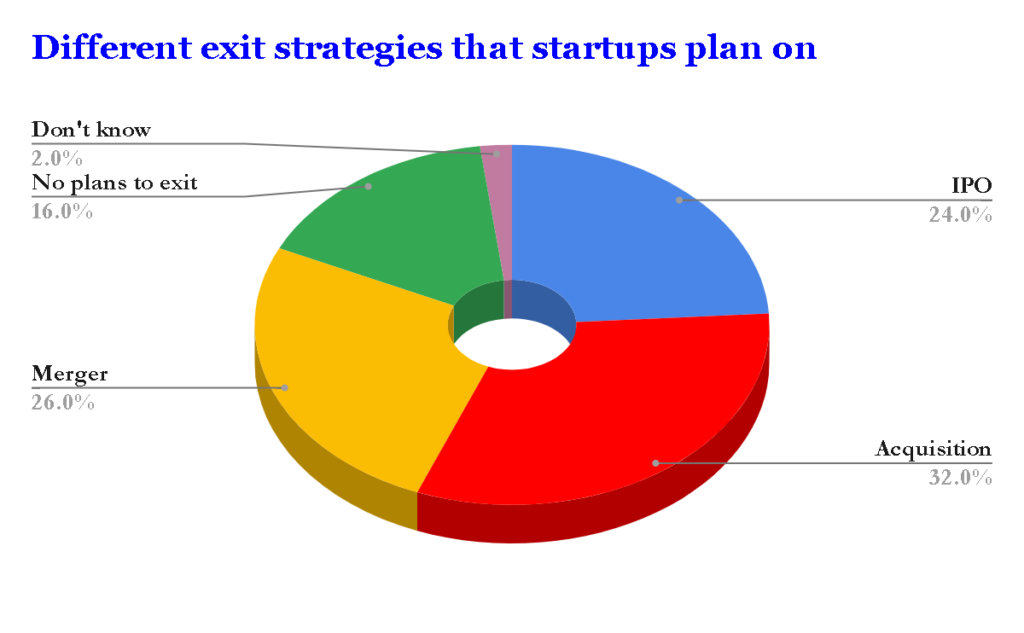

In the above chart, we have shown the most common ways that entrepreneurs plan their startup exit strategies. You do not want to belong in the green or purple section of the chart. While confidence is good, thinking that your business will never need an exit strategy is a mistake and here’s why–

- The startup success rate is 10%, which means 90 out of 100 startups are not going to be successful and there is a chance that your idea might belong to the majority.

- Secondly, 20 percent of startups fail in their first year. 30% fail in the second year, and 50% fail by the fifth year. And by the 10th year, 70% of startups fail.

- In the case of venture-backed startups, the failure rate is 7.5 out of 10 as opposed to 9 out of 10.

- Only 1 percent of startups become unicorn firms like Uber, Airbnb, Slack, etc.

Now, for the most horrifying part-

If there isn’t a solid exit strategy, 30 to 40% of investors lose all their funds. And in the case of venture-backed startups, 75% of companies never return the cash to the investors.

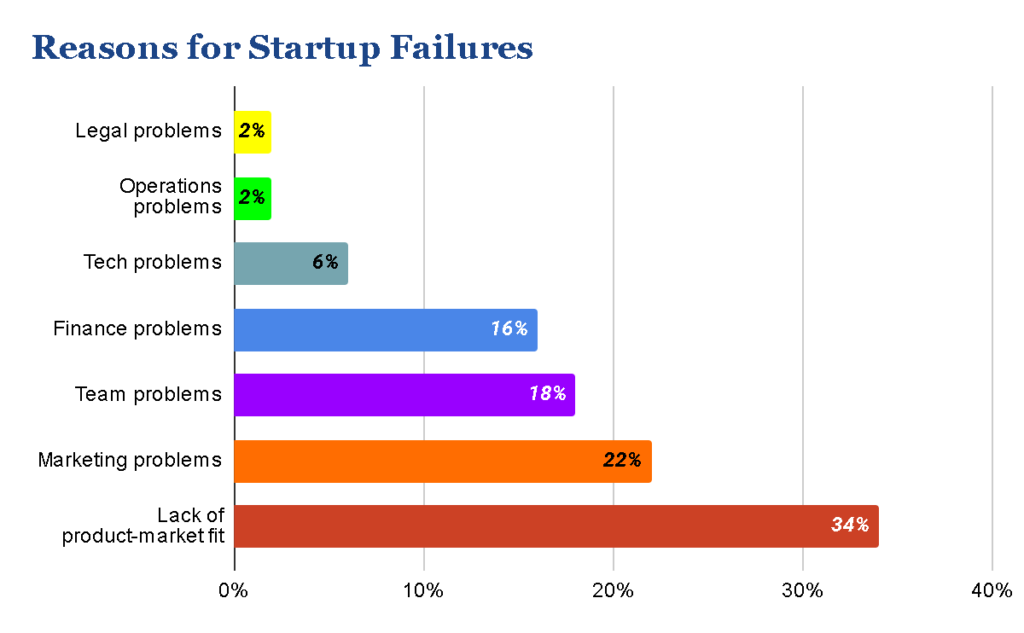

In the chart below, we have shown the most common reasons for a startup to need an emergency exit-

Types of startup exit strategy

We have discussed the top five exit strategies for startups and small businesses to explore.

Merger and Acquisition

Merger and Acquisition are two very different exit processes that are often mentioned together. When two companies combine their assets and finances and other administrative elements to become a single entity it is called a Merger. This process is just as complicated as it sounds.

The process of Acquisition is comparatively simpler for the selling company. Because in the acquisition, another company buys the management and investors out. If your company’s vision is important to you then acquisition can be difficult.

IPO(Initial Public Offering)

Although it is a very smart exit strategy it may not be well suited for a startup. The initial public offering is the first sale of stocks by a private company to the public. Since the public will have the access to the stocks it will be easy to raise equity capital for expansion. But this process works well for well-established companies.

Liquidation

Liquidation is often a safe path to get out of the ownership of a company. It lets the owner or investor or other stakeholders time to slowly unwind the business. In this case, unwinding means living off of the revenue instead of reinvesting the money earned. Then when the business is no longer generating profit, they close it down. If anything is left after this process they are sold, debts are paid off, and if anything is left after, that goes to the former owner.

Management Buy-out

In this strategy, the newer generation of management employees takes over the business. This is a kind of handover or succession that needs heavy planning. After all, the success of the handover depends on the employee’s capability to front the money or secure the credit. Additionally, it takes a lot of time to plan this handover. But, there are certain advantages of structuring the sale for a long period of time unless one of the parties decides to back out.

Third-Party Sale

Third-party sale is also a smart and lucrative exit strategy. This means selling the company to a third party in the market who is keen on succession. This also means a higher price and negotiable terms.

Startup exit strategies for investors

Among the above-mentioned strategies, Merger and IPO are beneficial for investors but here are two other strategies that are not very popular but can be of immense help to the investors–

Private Offerings: Unlike IPO, you can sell your shares privately to a select group of individuals or companies. Furthermore, these private offerings don’t need to be registered with the SEC and you can avoid the required reporting arrangements of the SEC. This process is less expensive and quicker than an IPO. Hence, beneficial to the investors and stakeholders.

Regulation A+: Regulation A+ is a skeleton version of IPO where you put your startup on an exchange after you qualify. In this process, you need to agree to certain stipulations laid down by the SEC(Securities and Exchange Commission). But you don’t have to publish accounts publicly or file other mandatory reports that you have to do in IPO.

There are more than five exit strategies but the five most important and popular ones are–IPO(Initial Public Offering), Merger and Acquisition, selling your stakes to a partner, family succession, and liquidation.

The smarter idea is to always plan an exit strategy before going full-on into business because not all startup ideas are meant to survive the struggle.

It is the process when an entrepreneur or an investor wants to exit a startup they have invested in or have set in motion through IPO, Merger, Acquisition, Liquidation, etc.

The most common exit strategy for a startup is Acquisition. Mergers and Acquisitions are two of the best exit strategies for startups.